GCash users can now avail of loans as low as P100 to pay for minor and urgent purchases with GCash Sakto Loans.

This new nano loan feature from GCash and Fuse Lending Inc. enables users to easily borrow small amounts as “pambale” without having to go through the hassles of paperwork.

A GCash study found that nine out of 10 Filipinos have to borrow money to make ends meet. But with the rigorous loan application process set by formal institutions and banks, more than half resort to borrowing from informal lenders with high interest rates and sometimes abusive collection practices.

“Sakto Loans serves as an expansion of our suite of lending options GLoan, GCredit and GGives, which has provided users with a convenient way to borrow money with just a few taps on their phone. Through access to fair lending, we are able to provide more Filipinos access to borrowing means that truly prioritizes their needs,” said Tony Isidro, CEO of Fuse.

GCash Sakto Loans serves as an entry-level loan for those who are not yet eligible to borrow larger amounts on the app but are in need of small amounts to supplement their budget.

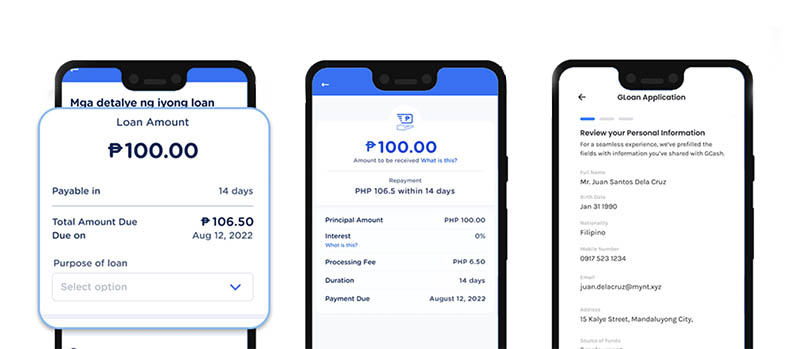

GCash users may borrow anywhere between P100 and P500 with zero interest, payable in 14 or 30 days. Note, however, that there is a processing fee that ranges from P6.50 to P75, depending on the amount borrowed.

Since 2016, Fuse has disbursed PHP 100 billion in loans and has helped over 3 million Filipinos achieve their dreams. With the inclusion of a nano-loan offer in its extensive lineup of lending products, GCash and Fuse hope to expand its vision of making financial services more accessible to Filipinos, including the unbanked.

.jpg)

-x-250px(H)-copy (1).png)