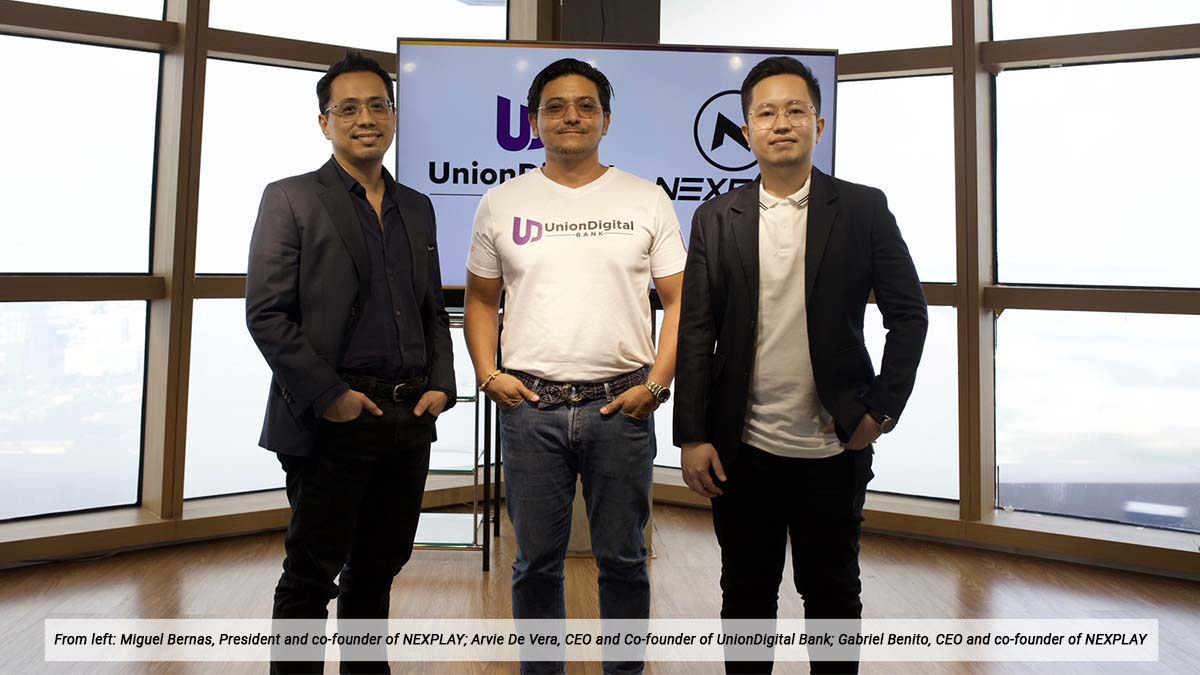

Southeast Asian esports and video game content ecosystem Nexplay and UnionDigital Bank, the digital banking arm of UnionBank, have signed an exclusive partnership that aims to offer more convenient digital financial services for Filipino gamers.

With this tie-up, Filipino gamers will be given more accessible financial solutions not limited to traditional deposit accounts and debit/credit cards.

“Our partnership with Nexplay allows us to offer our financial services to today’s Filipino gamers, enabling them more by giving access to a digital bank account,” said Arvie De Vera, co-founder and CEO of UnionDigital Bank.

In 2019, 43 million Filipino gamers spent a total of $572 million on games and four-fifths engaged with in-game microtransactions such as buying power-ups and game cosmetics. The following year, revenue generated by the online gaming industry sat at $24 million.

“Nexplay opens opportunities for us to engage our country’s digital natives in platforms they are quite familiar with: games. This is particularly important if you consider the rise of play-to-earn gaming and content streaming in the Philippines,” added De Vera.

“For Nexplay, our mission has always been helping gamers succeed. Working with UnionDigital Bank will help crystallize this combined vision of making financial services more accessible to our massive gaming community, our fans, our teams and our talents to enrich their digital experience,” shared Gabriel Paulo Benito, co-founder and CEO of Nexplay.