When it comes to spending, it’s important to differentiate between what you need and what you want. “Needs” are the essentials that you cannot go any significant period of time without such as food and shelter. “Wants,” on the other hand, are those that you’d like to have but that you can get away without having—a good cup of coffee, a limited-edition pair of sneakers, or a big-ticket item that you treat yourself with and that you justify by saying, “Deserve ko ‘to!”

And that’s not necessarily a bad thing. After all, you worked hard for your money and you deserve to enjoy the fruits of your labor. However, if you’re not careful with how you manage your money, chasing after your wants can compromise your ability to take care of the things you need.

To help more Filipinos take better care of their finances, financial management app Lista shares the following tips to help you stay on top of your needs and to make financial room for the things you want:

1. Check yourself… and your spending

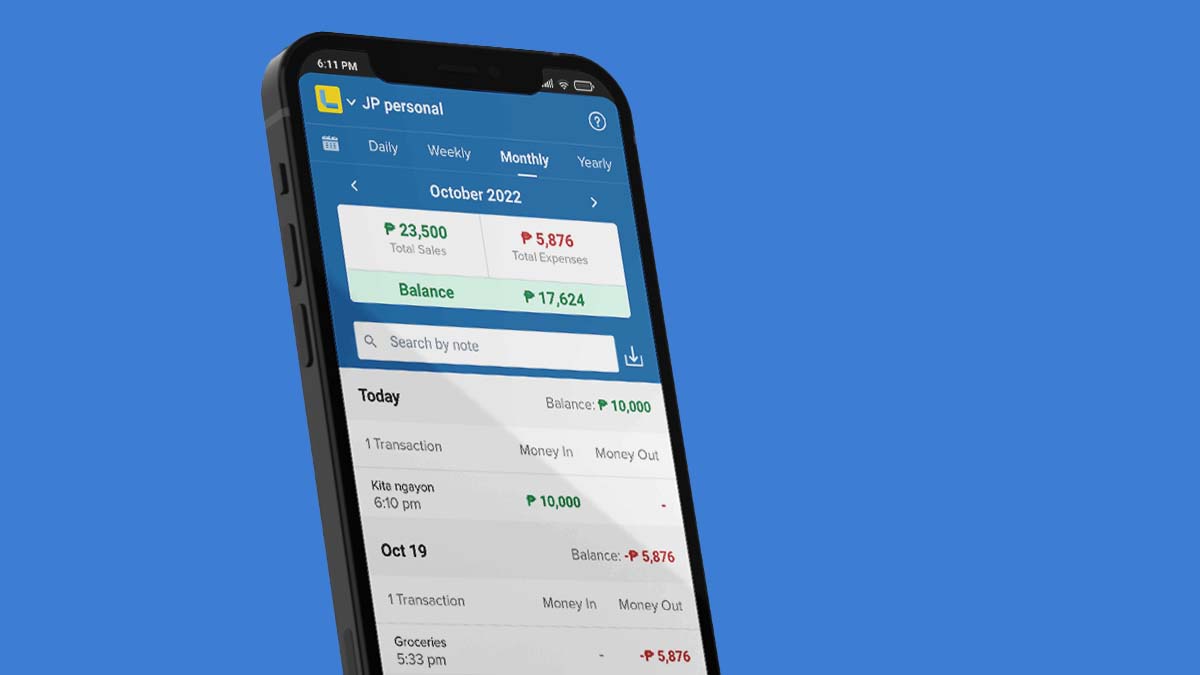

Keeping track of what you spend on is the first step to saving money. From your morning coffee to your monthly bills, there are many ways to record your expenses. To monitor the money coming in and out of your pocket with ease, Lista PH houses an expense tracker that’s simple, powerful, and accessible from your smartphone. This makes it easier to keep track of your spending and stay informed on what eats up too much of your finances.

2. Take control of your budget

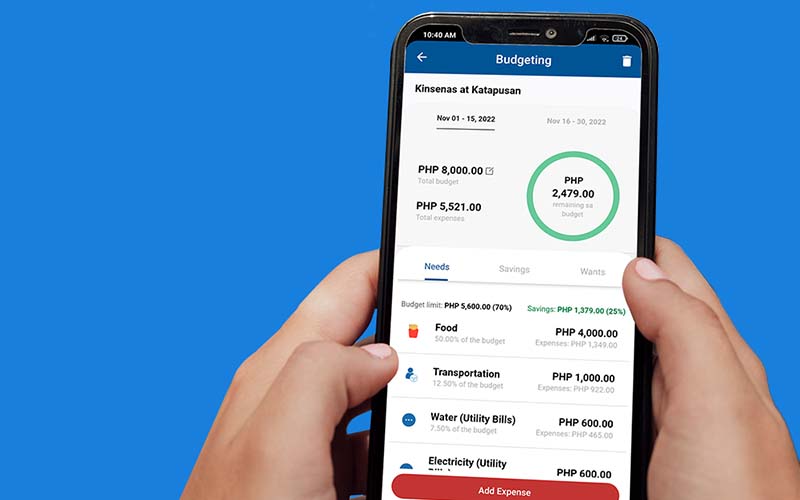

Once you know how much you spend, it becomes much easier to create a budget. Setting a budget should show your expenses in relation to your income which helps in making it easier to plan your spending and limit overspending.

Lista’s Personal Budgeting feature helps you achieve your financial goals—whether you’re paying off debt or saving money for the long term. The app allows you to set a preferred budgeting cycle, make it easy to list expenses, and share additional insights to help you with your budgeting needs.

3. Cut out non-essential spending

Looking at your budget and your expenses makes it easier to identify non-essential spending like eating at restaurants or going out. Other ways to save on everyday expenses include reviewing any recurring charges for seldom-used subscriptions or services, researching for promos in restaurants, or waiting for a sale on things you want.

4. Level up your spending game

After expenses and income, financial goals are the most likely factors to influence how you allocate your savings. Start by thinking about the things you want to save for, and from there, you can estimate how much money you’ll need, and how long it would take you to reach those amounts.

Lista PH’s Savings feature aims to empower you to meet savings goals and set financial targets for the things you want to buy. Whether you’re aiming to save P500 to buy what’s in your online cart or to put away the funds for a down payment on a car, making the act of saving a habit with the help of Lista can help make it easier for you to stick to your short-term and long-term financial goals.

At the end of the day, responsible budgeting and spending on yourself shouldn’t feel impossible to balance. These four steps can help ensure you get to treat yourself to what you want without biting you back in the long run. Having a responsible way to keep track of your spending and your budget can lessen worries and remove the “guilty” from guilty pleasures.