During its maiden #BPITechTalk last August 12, Bank of the Philippine Islands (BPI) executives shared how its customers benefit from the bank’s retail digital platforms and how their accounts are protected from cyber scammers.

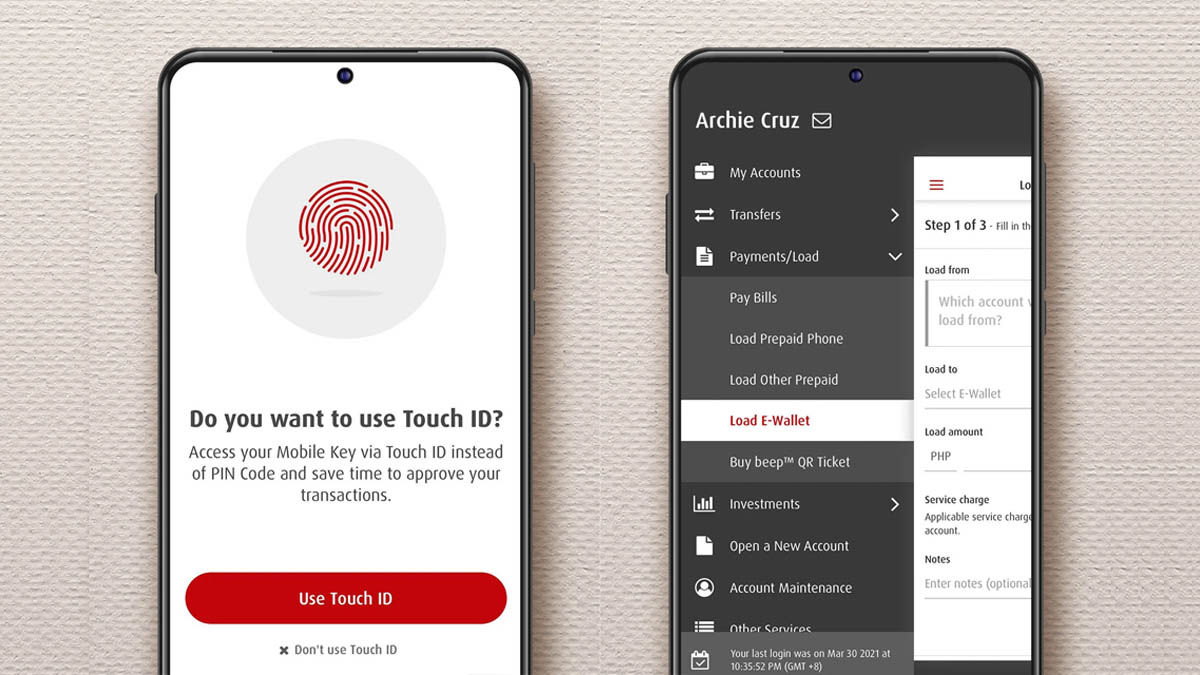

The presentation “A Smart and Easy Digital Experience” highlighted the history and milestones of BPI Online and BPI Mobile, their smart and convenient features, as well as their top uses.

“[BPI’s Digital Banking’s] intuitive features are built for convenience, ease and security. Customer experience is at the forefront as BPI continues to develop Digital Banking functionalities which make both the online and mobile banking app highly responsive to customers’ needs,” said Fitzgerald Chee, BPI Consumer Platforms Business Lead.

BPI continues to invest heavily in technology, including cybersecurity, to ensure that the bank can provide safe, convenient, and secure digital financial services.

Meanwhile, BPI Enterprise Information Security Officer and Data Protection Office Jonathan John Paz gave a glimpse of how technologically secure BPI Online and Mobile are. In his presentation, “Cybersecurity Made Simple,” he also showed how the platforms are empowering its users to manage their online security.

“We follow a secure mobile app development regimen to build a robust BPI Mobile app,” Paz said. “We keep abreast of the developments in the digitalization front and the evolving threat landscape. We continue to invest heavily in technology, especially in cybersecurity, to ensure we are able to deliver superior user experience, securely.”

He shared an overview of the industry and digitalization trends, including drivers for a mobile-first strategy, threats to mobile banking, and the threat forecast for 2022.

#BPITechTalk is a one-hour, monthly media roundtable series where updates on the bank’s tech initiatives and capabilities are presented by top BPI executives.

.jpg)

-x-250px(H)-copy (1).png)